Emerging markets represent a significant and growing portion of global GDP, offering immense potential for businesses seeking expansion. Yet, outdated perceptions and persistent myths often cloud judgment and prevent companies from seizing valuable opportunities.

At Larive International, we work closely with businesses navigating these dynamic landscapes. Insights gathered from our partners on the ground highlight the gap between common assumptions and the reality of doing business in these regions. Our colleague Maik delved into the matter to debunk some key misconceptions:

Myth 1: Africa lacks a substantial middle class and primarily produces raw materials.

Reality: This view is increasingly outdated. While resource extraction remains important for some economies, local consumption across many emerging markets, including numerous African nations, is surging. A rapidly growing middle class is driving demand for diverse goods and services. The “Local for Local” production trend is not just a concept but a gigantic opportunity for businesses catering to domestic needs. Furthermore, the services sector in many emerging economies is vibrant, expanding rapidly, and contributing significantly to economic growth.

Myth 2: Emerging markets are universally unstable, poorly governed, and fragile.

Reality: A pervasive misconception is that emerging markets are universally unstable, poorly governed, and fragile. This often extends to treating vast, diverse regions as monolithic entities – the prime example being the frequent, inaccurate reference to “Africa” as if it were a single country or market. The reality is that EMs exhibit incredible diversity. Stability, governance quality, regulatory environments, economic structures, and cultural contexts vary dramatically not just between countries but often within them. Africa alone comprises 54 distinct nations. Success absolutely hinges on discarding these generalisations and investing in understanding the specific, local realities of the target market. A successful market entry strategy must be adapted to these specific local realities, not based on generalised fears. Remember, a significant portion of global GDP growth originates from these markets.

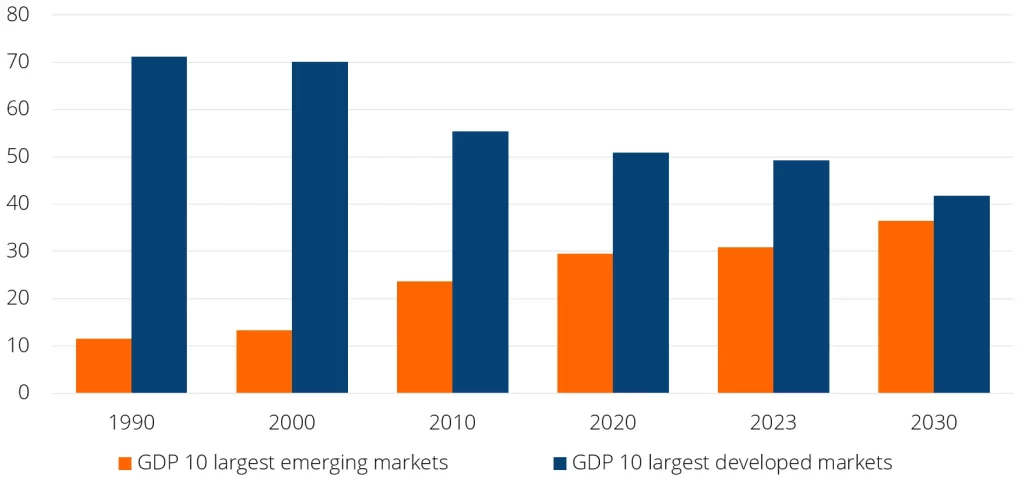

Emerging markets’ GDP catching up to developed markets (%)

Data compiled Aug. 31, 2024. 2030 is not our forecast. It is a scenario that assumes productivity and labour force participation will average the same as it has in the past decade, taking into account UN population projections and stable real exchange rates. Sources: International Labour Organization; United Nations; World Bank; S&P Global Ratings.

Myth 3: Eastern Europe’s value proposition is solely low-cost labour.

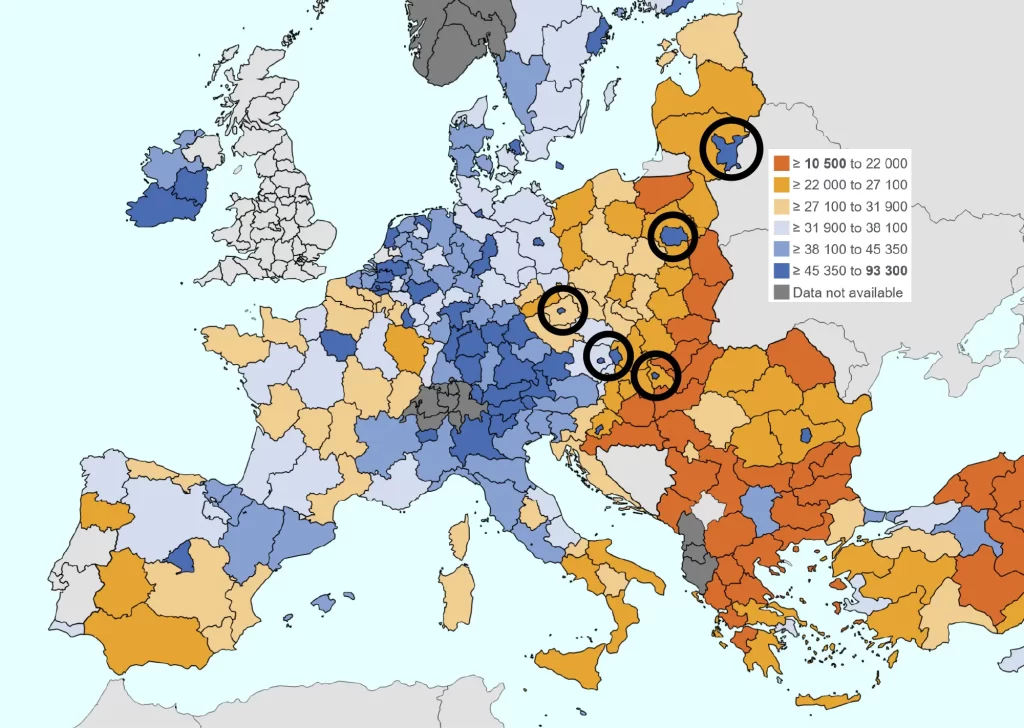

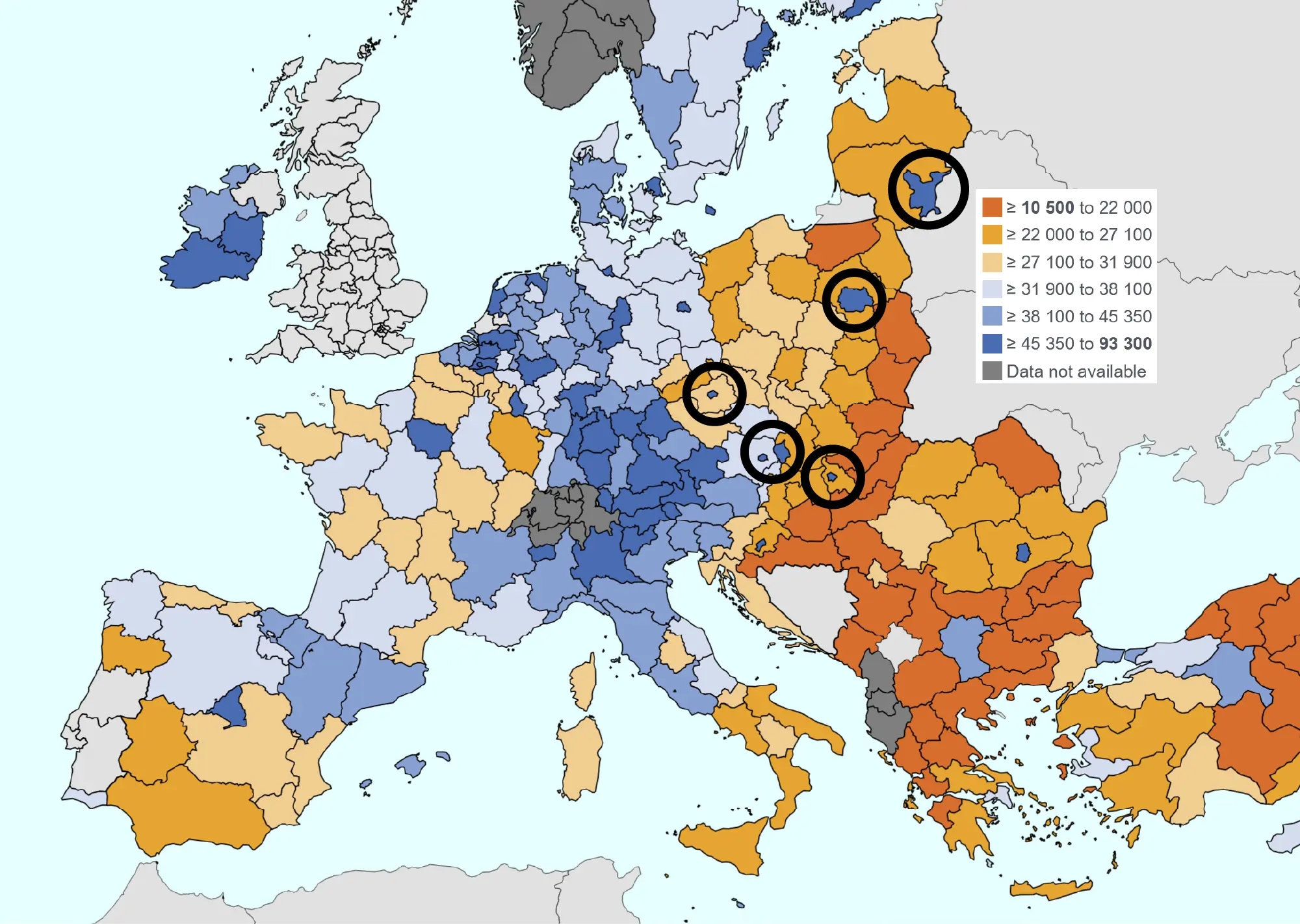

Reality: While cost competitiveness has historically been an attractor, viewing Central and Eastern Europe (CEE) merely as a source of cheap labour overlooks its significant evolution. The region boasts a highly skilled and educated workforce, particularly strong in STEM fields, IT, and engineering. Numerous countries have become hubs for R&D, advanced manufacturing, and tech innovation, offering sophisticated capabilities and solutions, often leapfrogging older technologies seen elsewhere. Furthermore, EU membership for many CEE countries provides regulatory stability and seamless access to the wider European market. Businesses increasingly look to the region not just for cost savings, but for talent, innovation, and strategic market proximity. This becomes especially visible when plotting the GDP per capita per region. Especially the capital regions have developed high productive and complex economies.

2023 Purchasing power standard (PPS, EU27 from 2020), per inhabitant (source)

Myth 4: Asia is primarily a manufacturing base that copies Western innovation.

Reality: The notion of Asia as simply a low-cost manufacturing hub or imitator of Western technology is decades out of date. Today, the continent is a powerhouse of innovation in its own right. From world-leading semiconductor production in Taiwan and South Korea, to cutting-edge consumer electronics, advancements in AI and fintech in China and Singapore, a booming digital economy across Southeast Asia, and a rapidly growing tech startup scene in India, Asia is driving global technological progress. Asian countries are leaders in R&D investment and patent generation. Furthermore, innovation isn’t confined to high-tech sectors; successful consumer product concepts and business model adaptations also emerge from the region – consider how the globally recognised Red Bull energy drink was inspired by Thailand’s Krating Daeng. Businesses looking towards Asia should recognise it not just for production capacity, but as a vital source and market for cutting-edge technology and innovative concepts across various industries.

Myth 5: Africa (and many EMs) lacks skilled labor, infrastructure, and is solely dependent on aid.

Reality: While development levels vary, this stereotype overlooks significant progress.

Skilled Labour: Talent pools are deepening across many emerging markets, fuelled by improving education systems and a young, ambitious workforce. Finding and developing local talent is often a key success factor.

Infrastructure: Significant infrastructure investment is flowing into emerging markets, spanning digital connectivity, mobile finance, transport, and energy. This development, often facilitated by Multilateral Development Banks (MDBs) expanding their reach, like the European Bank for Reconstruction and Development’s (EBRD) recent move into Benin, is creating new efficiencies and unlocking substantial business opportunities.

Aid Dependence: While foreign aid can play a role, domestic economic engines, intra-regional trade, foreign direct investment, and remittances are increasingly powerful drivers of growth in many emerging economies. The total remittance industry currently stands at ~USD 750 Bn, expected to grow to USD 1 Trillion by 2029. Far outpacing aid budgets.

Myth 6: EM currencies are excessively risky.

Reality: Currency volatility is a genuine factor in many emerging markets, impacting everything from import costs to profit repatriation. Risks like depreciation or difficulties in conversion exist. However, characterising this as an insurmountable barrier is inaccurate. These risks are not uniform across all EMs, and numerous strategies exist to mitigate them, including hedging instruments (where available), local currency borrowing, dynamic pricing strategies, and structuring investments carefully. Successful businesses factor currency risk management into their core strategy, rather than avoiding markets altogether. Understanding the specific currency dynamics and regulatory environment of the target market is crucial.

Key takeaway

Success in emerging markets hinges on moving beyond stereotypes and investing time and resources in gaining deep, nuanced local understanding. Opportunities abound for companies willing to look past the myths, adapt their strategies, and engage with the dynamic realities of these diverse and rapidly evolving economies.

Ready to explore the real opportunities in emerging markets? Larive International provides the market intelligence and strategic guidance needed to navigate complexities and achieve sustainable growth. Contact our colleague Maik to learn how we can support your international expansion goals.